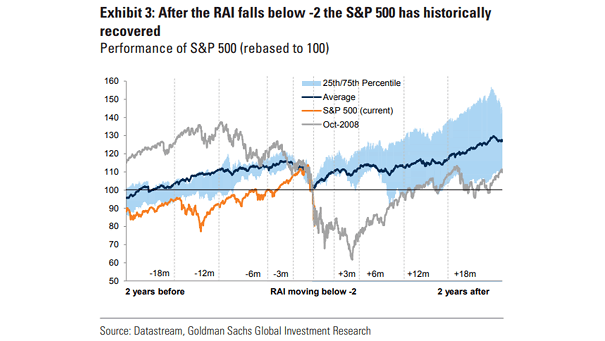

S&P 500 Performance and Risk Appetite Indicator

S&P 500 Performance and Risk Appetite Indicator This chart suggests that the S&P 500 has historically recovered, after the Risk Appetite Indicator falls below -2. Image: Goldman Sachs Global Investment Research