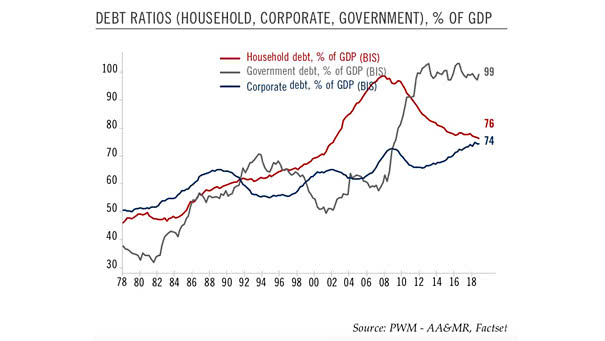

U.S. Debt Ratios to GDP (Household, Corporate, Government)

U.S. Debt Ratios to GDP (Household, Corporate, Government) U.S. households remain far less in debt than during the Great Recession, but U.S. corporate debt continues to rise rapidly and has exceeded record levels . Image: Pictet Wealth Management