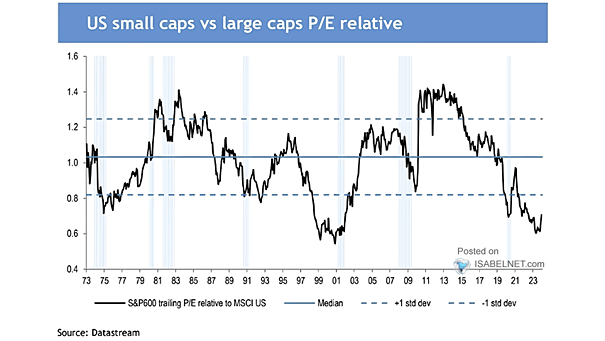

Valuation – U.S. Small Caps vs. Large Caps P/E Relative

Valuation – U.S. Small Caps vs. Large Caps P/E Relative Considering the appealing valuations, should investors increase their allocation to U.S. small-cap stocks relative to U.S. large-cap stocks? Image: J.P. Morgan