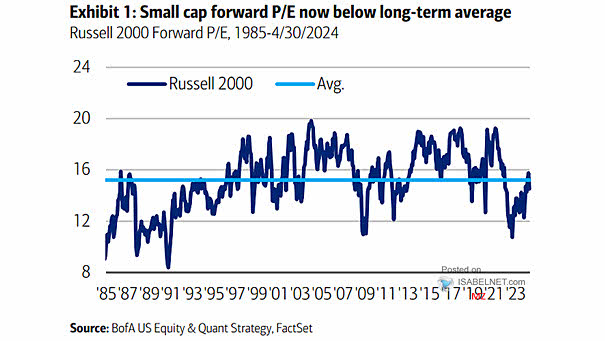

Valuation – Russell 2000 Forward P/E

Valuation – Russell 2000 Forward P/E The April sell-off has brought the U.S. small-cap forward P/E ratio back below the historical average, suggesting a potential undervaluation of small-cap stocks and creating buying opportunities for long-term investors. Image: BofA US Equity & Quant Strategy