May

22

2019

Off

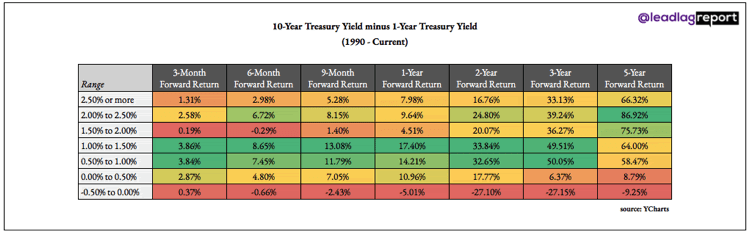

10-Year Treasury minus 1-Year Treasury Yield Spread vs. S&P 500 Returns

If history helps us to predict the future, the 10y-1y treasury yield spread suggests low returns ahead for U.S. stocks.

After 10 years of a bull market, our stock market forecasting model also shows that the market follows a different path in 2019.

Statistically, the expected returns for the coming years will be lower than the previous 10 years (R² = 0.97 since 1970).

Image: Michael A. Gayed