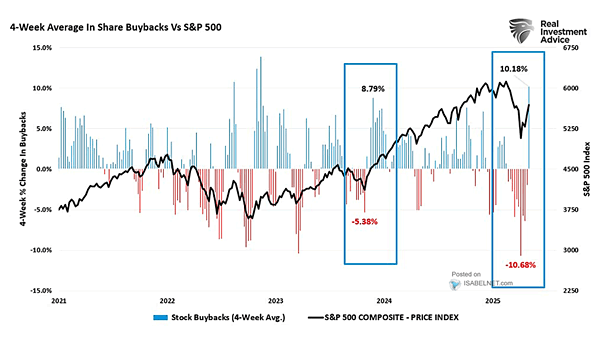

Stock Buybacks vs. S&P 500

Stock Buybacks vs. S&P 500 Companies entering full blackout periods remove a key source of support for further market gains. While this doesn’t guarantee a market decline, it does raise the risk of short-term volatility or weakness as corporate demand wanes. Image: Real Investment Advice