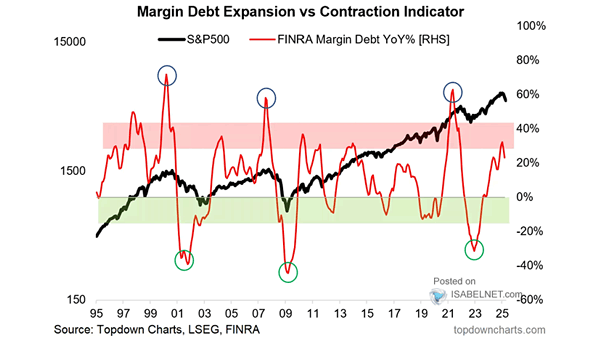

S&P 500 – Margin Debt Expansion vs. Contraction

S&P 500 – Margin Debt Expansion vs. Contraction A decline in margin debt has historically signaled impending market turbulence, as margin debt levels often reflect investor confidence and risk appetite. Image: Topdown Charts