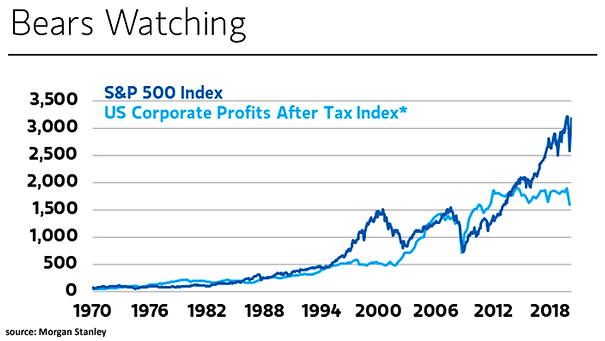

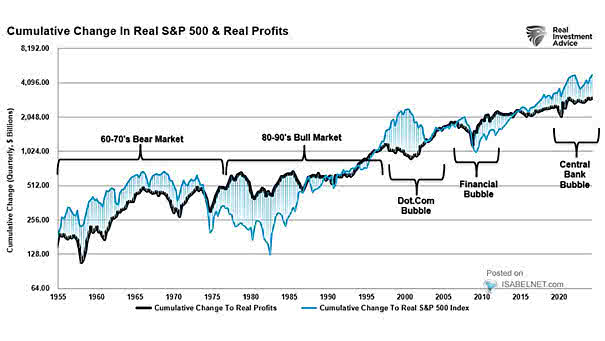

After-Tax Nonfinancial Corporate Profits as Share of Gross Value Added

After-Tax Nonfinancial Corporate Profits as Share of Gross Value Added While U.S. corporate profits fell in Q1 2025 due to higher costs and economic uncertainty, they remain historically high, reflecting both the strength and the vulnerability of large companies in the current economic climate. Image: Bloomberg