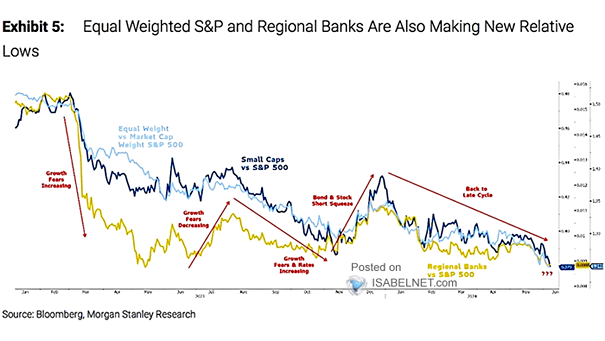

Performance – S&P 500 vs. S&P Regional Banks Index

Performance – S&P Regional Banks Index vs. S&P 500 Regional banks and the equal-weighted S&P 500 have recently reached new relative lows, a concerning trend in the financial market. This trend is noteworthy given the…