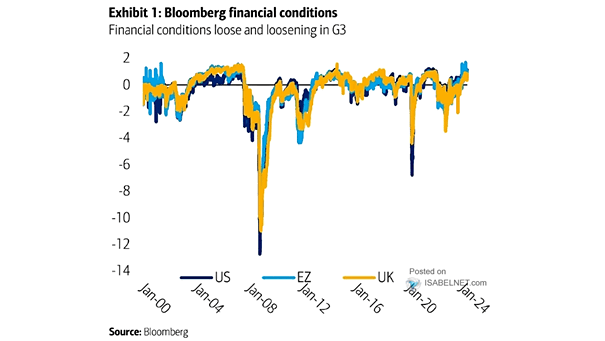

Financial Conditions

Financial Conditions Financial conditions in G3 economies have been experiencing a trend of loosening, posing challenges for central banks in their efforts to manage inflation and making it more difficult to keep it under control.…