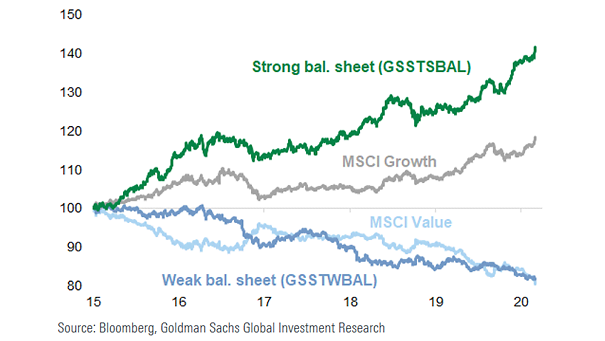

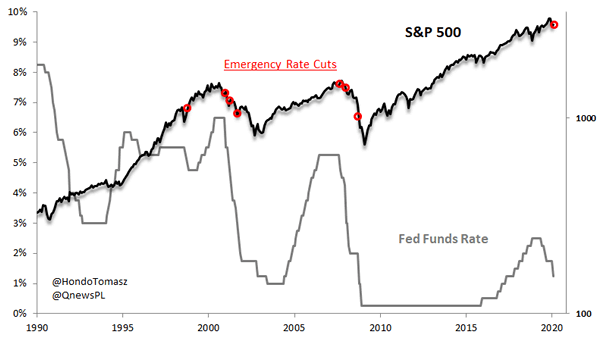

Companies with Strong Balance Sheet vs. Companies with Weak Balance Sheet

Companies with Strong Balance Sheet vs. Companies with Weak Balance Sheet Companies with strong balance sheet have outperformed companies with weak balance sheet. Typically, companies with weak balance sheet invest less. Image: Goldman Sachs Global…