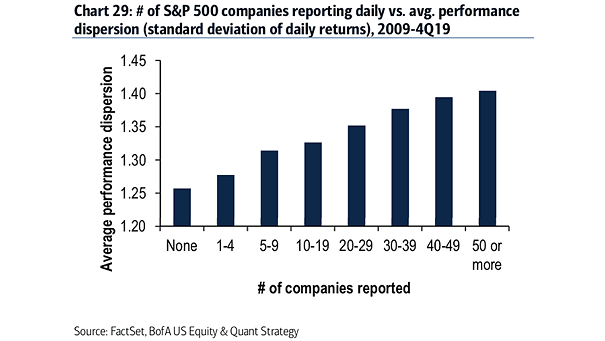

Volatility – Number of S&P 500 Companies Reporting Daily vs. Average Performance Dispersion

Volatility – Number of S&P 500 Companies Reporting Daily vs. Average Performance Dispersion As the number of earnings results increases, the higher the volatility of stock. Image: BofA US Equity & Quant Strategy