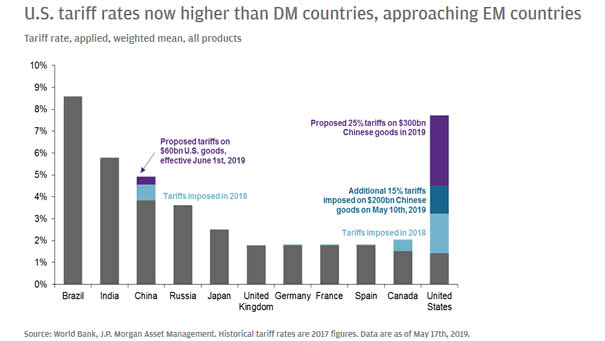

Effective vs. Statutory U.S. Tariff Rates

Effective vs. Statutory U.S. Tariff Rates While statutory tariff rates have jumped following swift policy changes, the effective tariff rate—the actual rate paid on imports—lags because of delayed enforcement, stockpiling, shifting trade routes, and ongoing…