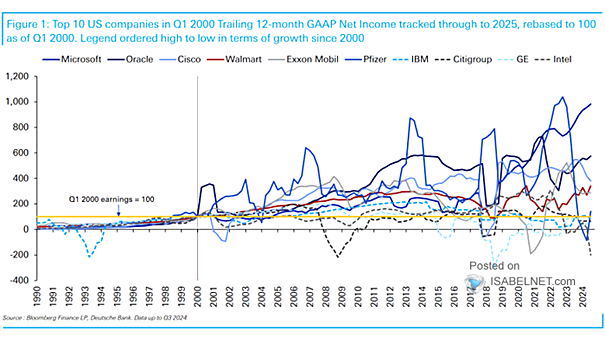

S&P 500 – Cumulative Total % Return of the Top 10 U.S. Companies

S&P 500 – Cumulative Total % Return of the Top 10 U.S. Companies Since 2000, maintaining dominance and consistently beating the S&P 500 has eluded almost all top-ten stocks except for rare cases like Microsoft.…