May

14

2019

Off

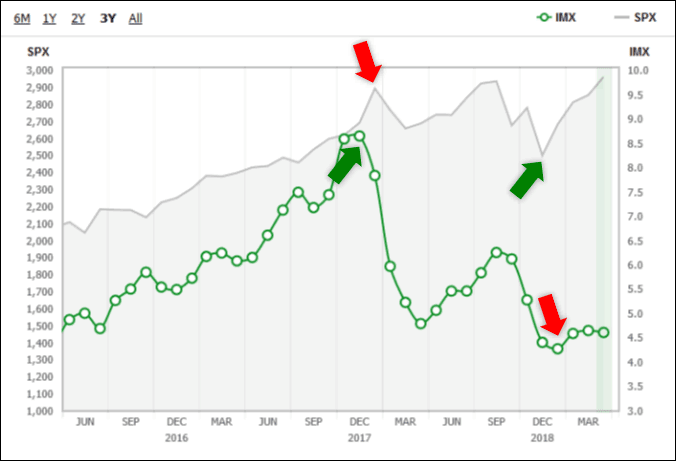

Investor Movement Index vs. S&P 500

The Investor Movement Index indicates the sentiment of TD Ameritrade retail investors.

Thus, retail investors are net buyers of equities when the stock market is expensive, and they are net sellers of equities when the stock market is cheap. As usual, retail investors react to equity price movements. They buy and sell equities at the wrong time and that’s not a good thing.

By using our great decision support tools, you will empower yourself to make much better investment decisions.

You may also like “Why the Average American Investor Still Underperforms the Market Over the Long Term“

Image: TD Ameritrade