One of the Best Yield Curves to Predict a Recession is Coming

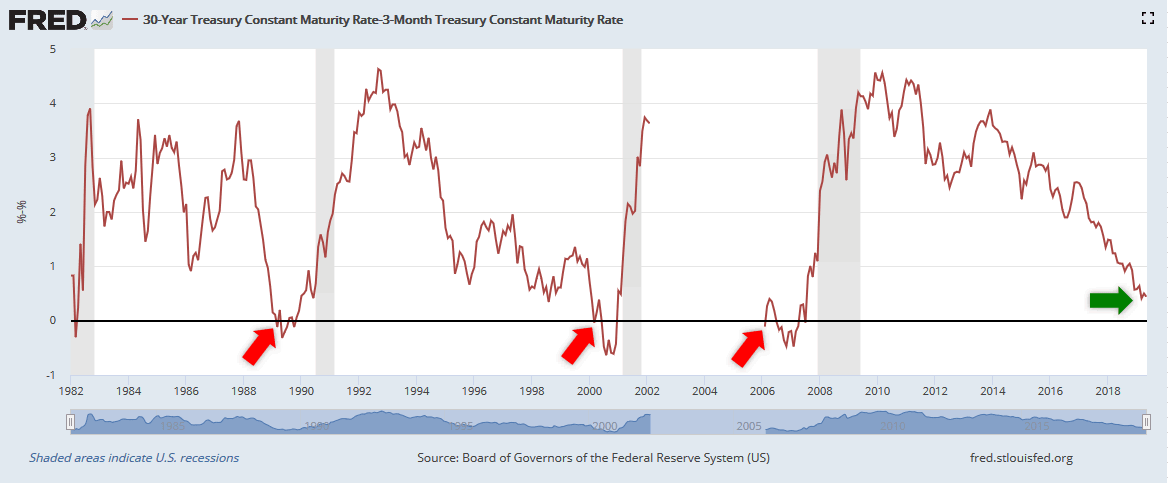

The spread between the 30-year and the 3-month treasury yields is one of the best recession signal of all the yield spreads. In recent history, a recession occurs about 12 to 18 months after the yield curve inverts.

When an inverted yield curve occurs, short-term interest rates exceed long-term rates. It suggests that the long-term economic outlook is poor and that the yields offered by long-term fixed income securities will continue to decline. Since 1962, no recession has occurred without an inverted yield curve.

An inverted yield curve doesn’t guarantee recession, we also need a widening of credit spreads and high real interest rates.

We are far away from that today. The 30-year/3-month spread suggests that there is no imminent recession on the horizon.