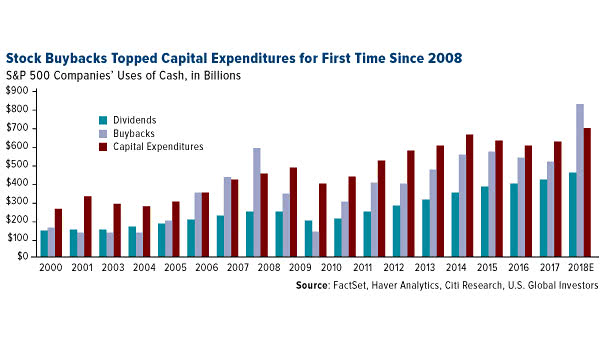

Stock Buybacks Topped Capital Expenditures for the First Time since 2008

Stock Buybacks Topped Capital Expenditures for the First Time since 2008 Thanks to corporate tax cuts, stock buybacks hit an all-time high and topped capital expenditures for the first time since 2008. As a reminder, 2008 was the start of the global financial crisis.