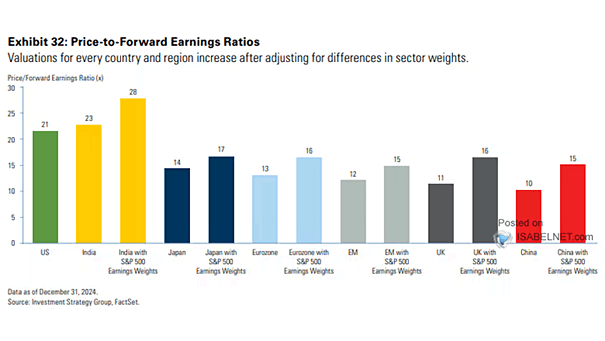

Valuation – Price-to-Forward Earnings Ratios

Valuation – Price-to-Forward Earnings Ratios The U.S. stock market maintains a premium valuation compared to global markets, with the exception of India, leaving little room for error as it’s priced for perfection. Image: Goldman Sachs Global Investment Research