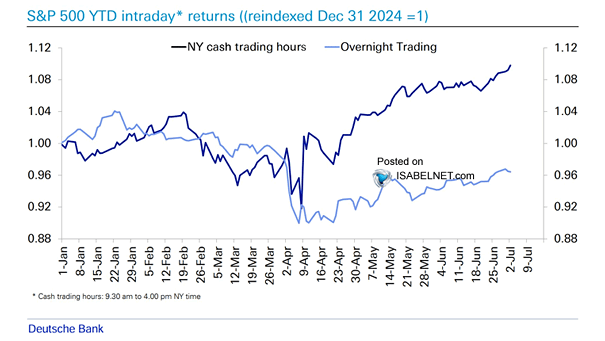

Indexed S&P 500 Return – Market Hours vs. Overnight

Indexed S&P 500 Return – Market Hours vs. Overnight Following the April market turmoil, most of the rally has happened during regular U.S. trading hours, with overnight returns remaining relatively muted. Image: Deutsche Bank Asset Allocation