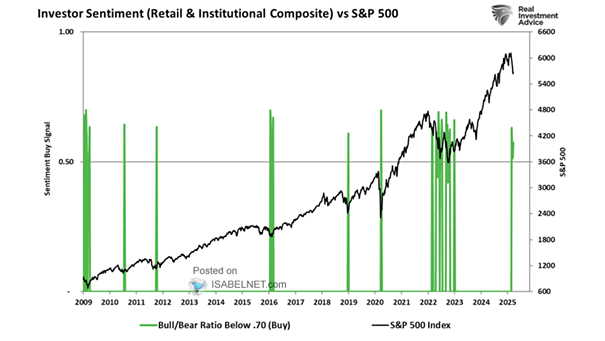

Investor Sentiment (Retail & Institutional Composite) vs. S&P 500 Index

Investor Sentiment (Retail & Institutional Composite) vs. S&P 500 Index Markets typically reach their correction lows when combined investor sentiment is extremely negative, setting the stage for a potential rebound. Image: Real Investment Advice