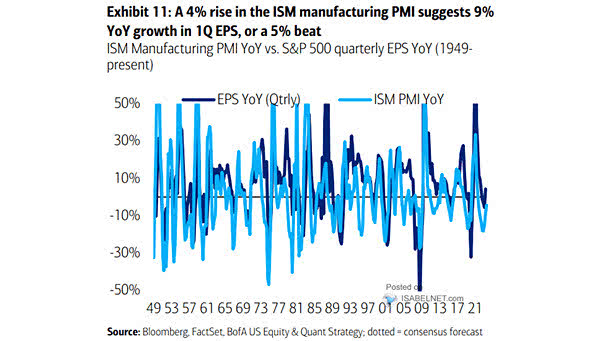

U.S. ISM Manufacturing PMI vs. S&P 500 EPS Growth

U.S. ISM Manufacturing PMI vs. S&P 500 EPS Growth A rise in the U.S. ISM manufacturing PMI is suggesting positive growth in 1Q EPS, with expectations of outperforming the initial projections. Image: BofA US Equity & Quant Strategy