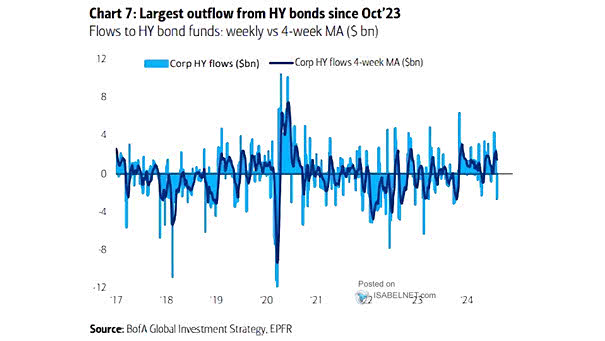

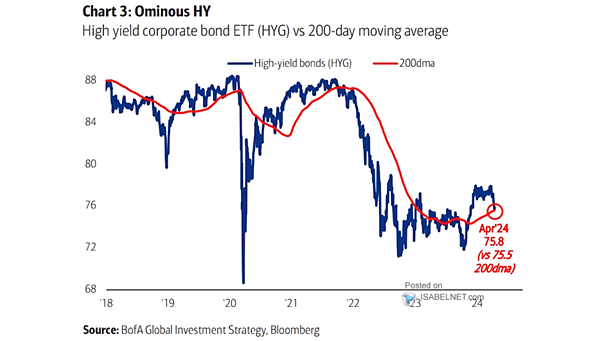

High Yield Bond Flows

High Yield Bond Flows Persistence outflows from high yield bonds could signal a lack of confidence in the underlying companies and their capacity to fulfill debt obligations, making it a crucial indicator to monitor closely. Image: BofA Global Investment Strategy