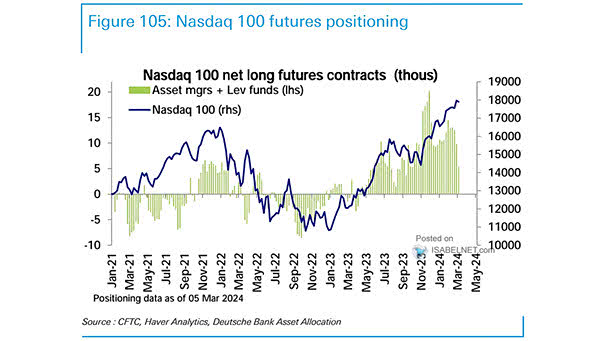

Nasdaq 100 Net Long Futures Contracts

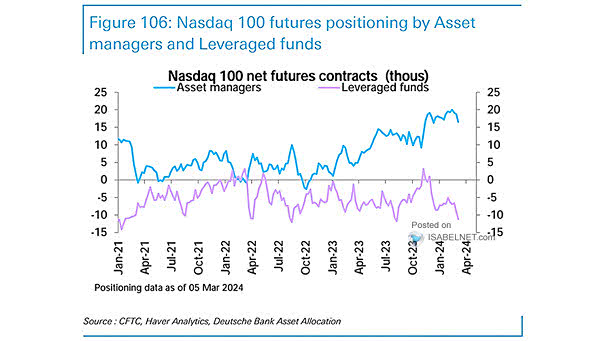

Nasdaq 100 Net Long Futures Contracts Leveraged funds and asset managers have different positions on Nasdaq 100 futures. Leveraged funds are currently very net short on Nasdaq 100 futures, while asset managers have a less bullish but still net long position. Image: Deutsche Bank Asset Allocation