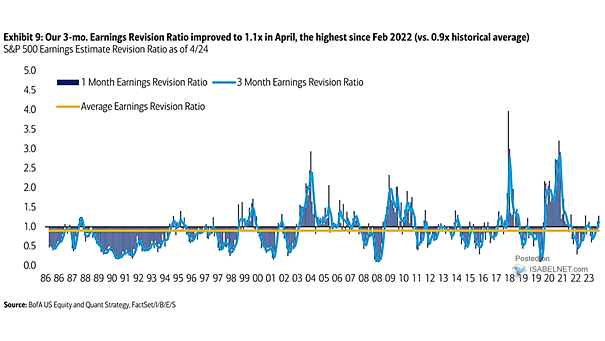

S&P 500 Earnings Estimate Revision Ratio

S&P 500 Earnings Estimate Revision Ratio The S&P 500 earnings estimate revision ratio has shown significant improvement, reflecting positive trends in earnings and expectations. Image: BofA US Equity & Quant Strategy