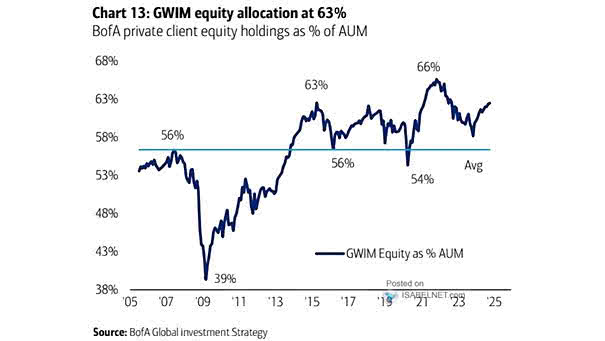

GWIM Equity Allocation as % Assets Under Management

GWIM Equity Allocation as % Assets Under Management BofA’s private clients show optimism about equity market growth and potential returns, as evidenced by their 63% portfolio allocation to equities. Image: BofA Global Investment Strategy