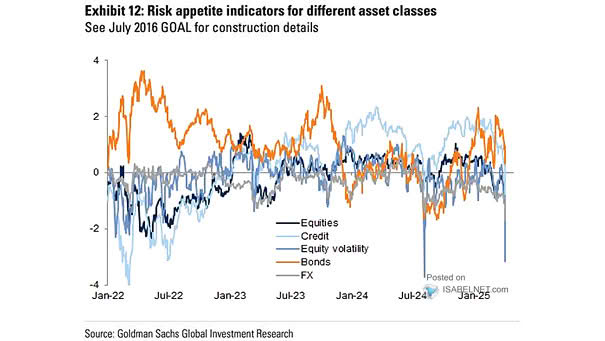

Risk Appetite Indicator for Different Asset Classes

Risk Appetite Indicator for Different Asset Classes Investors have sharply shifted toward risk aversion due to escalating tariff policies and eroding market visibility. Image: Goldman Sachs Global Investment Research