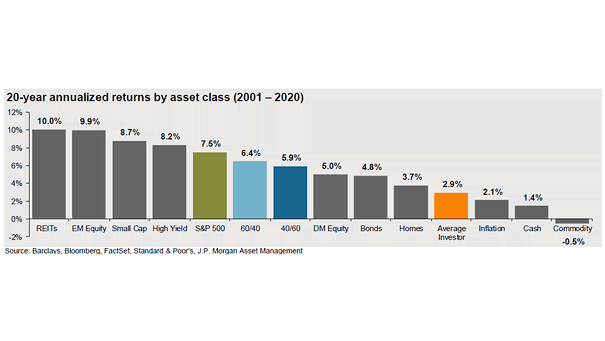

20-Year Annualized Returns by Asset Class

20-Year Annualized Returns by Asset Class The average American investor still underperforms the market over the long term, generally due to panic selling, emotional biases, the herding effect and lack of diversification. Image: J.P. Morgan Asset Management