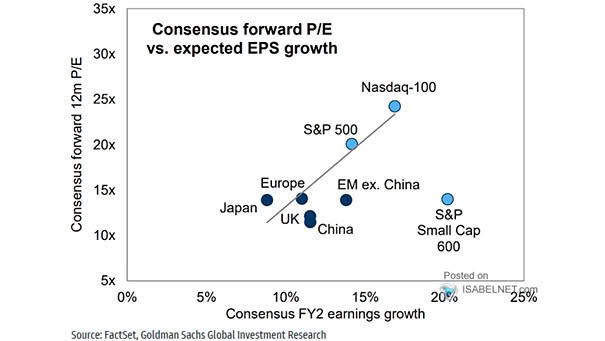

Valuation – Consensus Forward P/E vs. Expected EPS Growth

Valuation – Consensus Forward P/E vs. Expected EPS Growth The P/E premium reflects higher expected EPS growth, supported by a strong current correlation between EPS growth forecasts and P/E multiples. Image: Goldman Sachs Global Investment Research