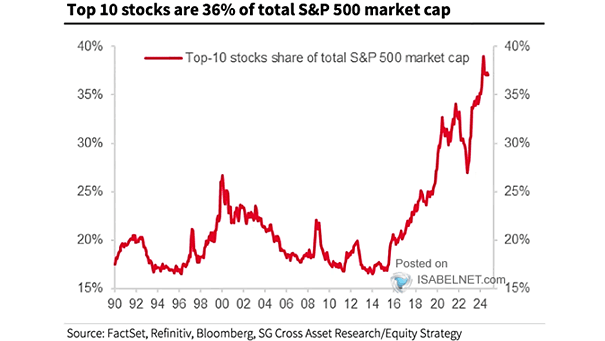

S&P 500 – Top 10 U.S. Companies by Market Capitalization Relative to Total

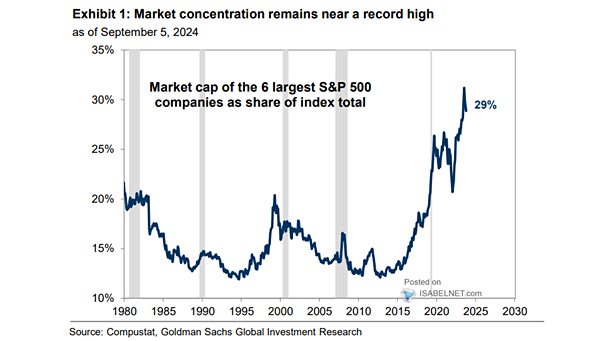

S&P 500 – Top 10 U.S. Companies by Market Capitalization Relative to Total The dominance of the top 10 U.S. companies in the S&P 500 Index raises concerns about the index’s ability to provide adequate diversification for investors. Image: Societe Generale Cross Asset Research