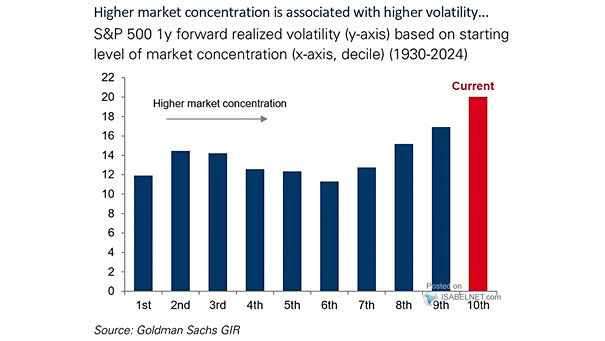

Concentration – Top 10 as % of Total (In Terms of Total Equity Market Capitalization)

Concentration – Top 10 as % of Total (In Terms of Total Equity Market Capitalization) Compared to the U.S. market, China’s equity market currently shows a historically low level of market capitalization concentration, indicating greater growth potential. Image: Goldman Sachs Global Investment Research