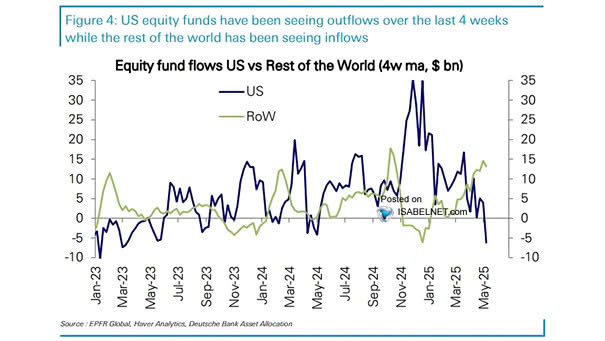

Equity Fund Flows U.S. vs. Rest of the World

Equity Fund Flows U.S. vs. Rest of the World Over the past four weeks, U.S. equity funds have experienced substantial outflows, while equity funds in other regions have recorded inflows, indicating a shift in global investor sentiment. Image: Deutsche Bank Asset Allocation