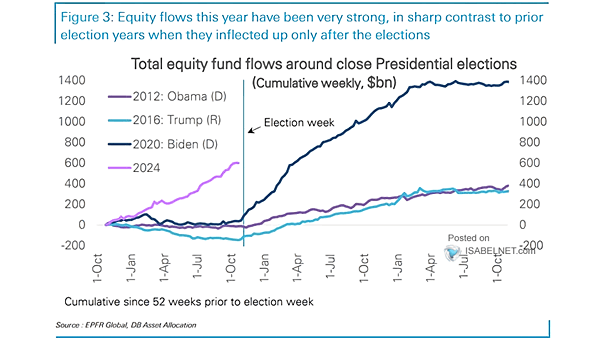

Total Equity Fund Flows

Total Equity Fund Flows Contrary to the usual caution observed in U.S. election years, 2024 has seen robust equity fund inflows, defying the typical pattern of investors waiting until after the elections. Image: Deutsche Bank Asset Allocation