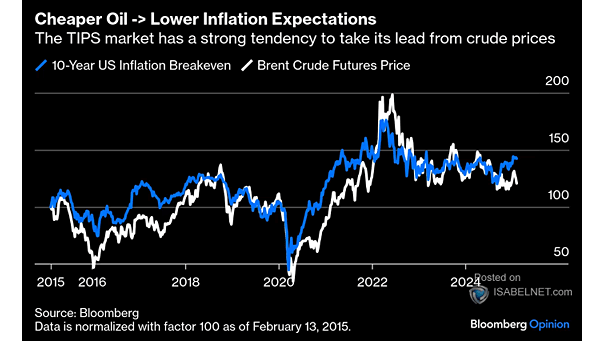

Oil Price vs. U.S. 10-Year Breakeven Inflation Rate

Oil Price vs. U.S. 10-Year Breakeven Inflation Rate Since the 2008 global financial crisis, U.S. breakeven inflation has closely tracked crude oil prices, reflecting the significant impact of oil price fluctuations on inflation expectations and overall economic conditions. Image: Bloomberg