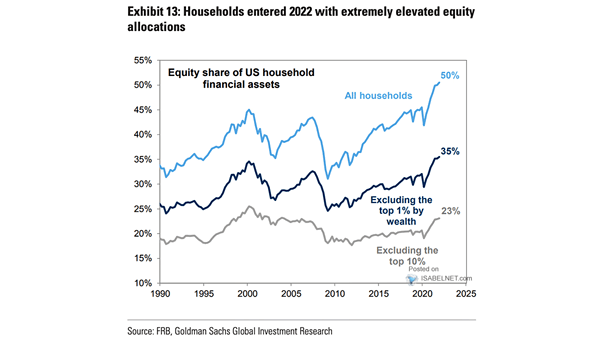

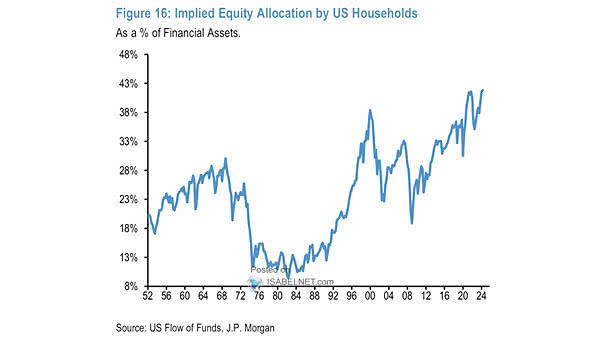

Equity Share of Household Financial Assets

Equity Share of Household Financial Assets Compared to U.S. households, Europeans exhibit lower stock ownership rates, which can be explained by cultural savings attitudes, structural differences in pension systems, and a stronger preference for liquid investments. Image: Goldman Sachs Global Investment Research