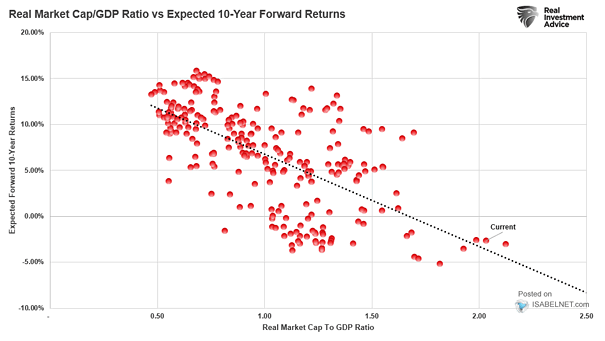

Real Market Cap to GDP Ratio vs. Expected 10-Year Forward Returns

Real Market Cap to GDP Ratio vs. Expected 10-Year Forward Returns The current elevated inflation-adjusted market capitalization to GDP ratio suggests the likelihood of anemic returns for the U.S. stock market over the next 10 years. Image: Real Investment Advice