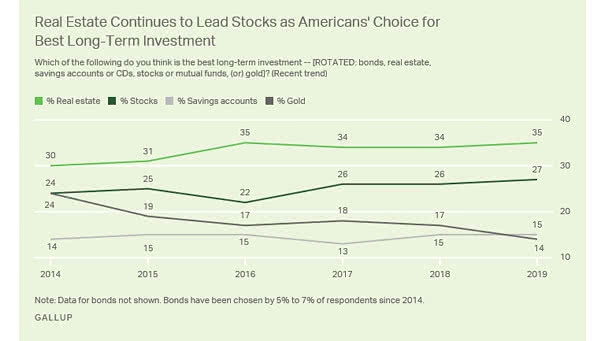

Real Estate Continues to Lead Stocks as Americans’ Choice for Best Long-Term Investment

Real Estate Continues to Lead Stocks as Americans’ Choice for Best Long-Term Investment Americans think that real estate is the best investment vehicle compared to other investments, such as stocks, bonds or gold. Image: Gallup