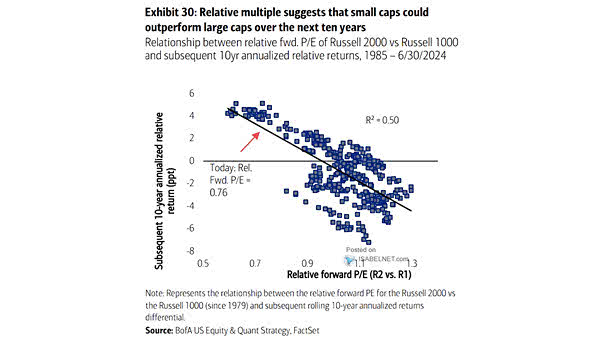

Small Cap Stocks – Relationship Between Relative Fwd P/E of Russell 2000 vs. Russell 1000 and Subsequent 10-Year Annualized Relative Returns

Small Cap Stocks – Relationship Between Relative Fwd P/E of Russell 2000 vs. Russell 1000 and Subsequent 10-Year Annualized Relative Returns For long-term investors, periods when small-cap stocks are trading at a significant discount to large-cap stocks may offer attractive investment opportunities. Image: BofA US Equity & Quant Strategy