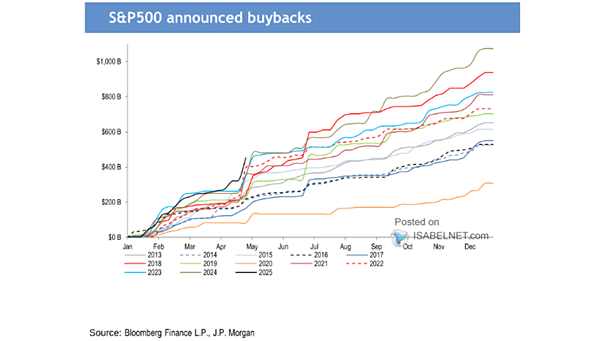

Buybacks – Announced Share Repurchases for S&P 500 Companies

Buybacks – Announced Share Repurchases for S&P 500 Companies In 2025, U.S. companies are announcing record share buybacks, with repurchases projected to surpass $1 trillion for the year—a move intended to support stock prices, improve financial metrics, and reassure investors. Image: J.P. Morgan