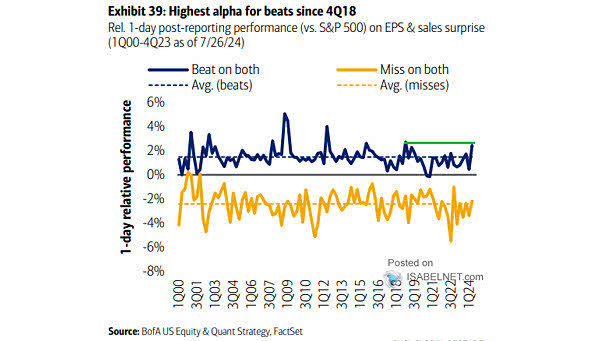

1-Day Post-Reporting Performance vs. S&P 500 on EPS and Sales Surprise

1-Day Post-Reporting Performance vs. S&P 500 on EPS and Sales Surprise Companies that exceeded both sales and EPS expectations outperformed the S&P 500 by 2.4ppt the following day, which is the strongest performance since 4Q2018 and considerably higher than the historical average of 1.5ppt. Image: BofA US Equity & Quant Strategy