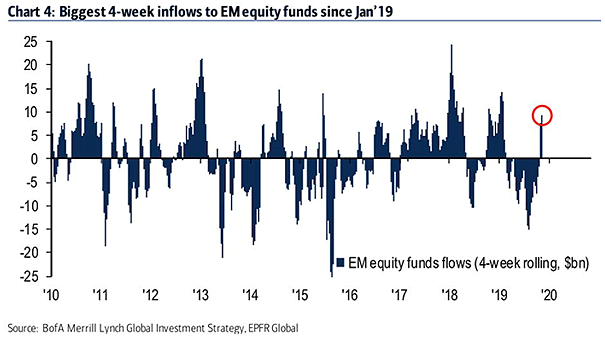

Inflows to Emerging Market Equity Funds

Inflows to Emerging Market Equity Funds Investors are back into emerging markets equities. This is the biggest 4-week inflows to emerging market equity funds since January 2019. Image: BofA Merrill Lynch Global Research