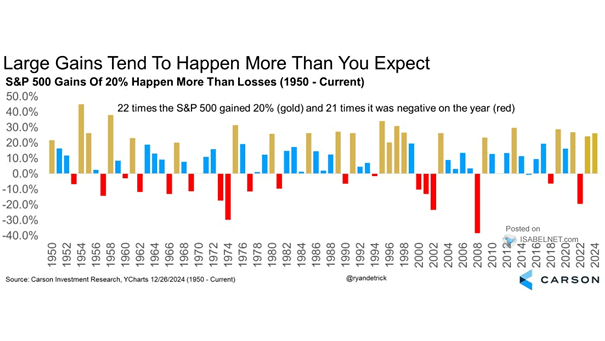

S&P 500 Gains of 20% Happen More Than Losses

S&P 500 Gains of 20% Happen More Than Losses Since 1950, the U.S. stock market has seen more years achieving gains of 20% or more than those with losses. This encourages investors to keep a long-term perspective and avoid panic selling—both crucial for building wealth. Image: Carson Investment Research