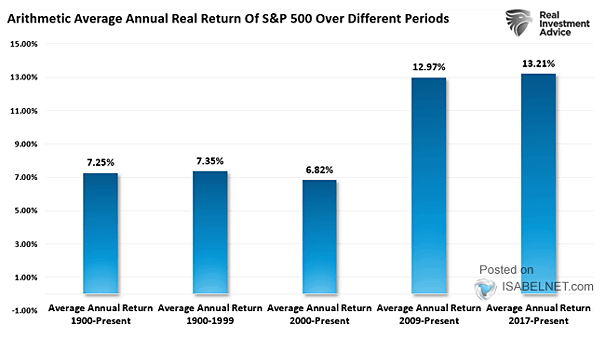

Arithmetic Average Annual Real Return of S&P 500 over Different Periods

Arithmetic Average Annual Real Return of S&P 500 over Different Periods U.S. equity investors often look to long-term historical stock market returns as a benchmark, wondering if current returns will revert to their historical averages. Image: Real Investment Advice