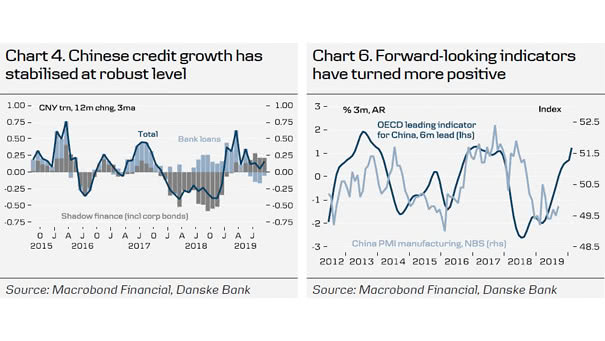

Chinese Credit Growth and OECD Leading Indicator for China

Chinese Credit Growth and OECD Leading Indicator for China Chinese Credit growth rebounded in September and suggests stronger activity on the horizon. The OECD leading indicator for China picked up further at the highest level since 2017. Image: Danske Bank Research