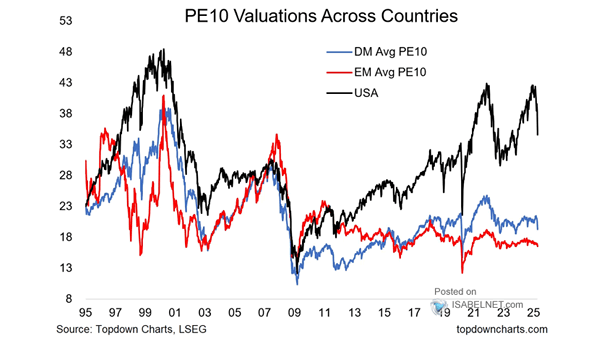

Valuation – PE10 Ratio: USA vs. Rest of the World

Valuation – PE10 Ratio USA vs. Rest of the World Investors seeking diversification and long-term growth may prefer emerging markets and non-U.S. developed markets over U.S. stocks due to their attractive valuations. Image: Topdown Charts