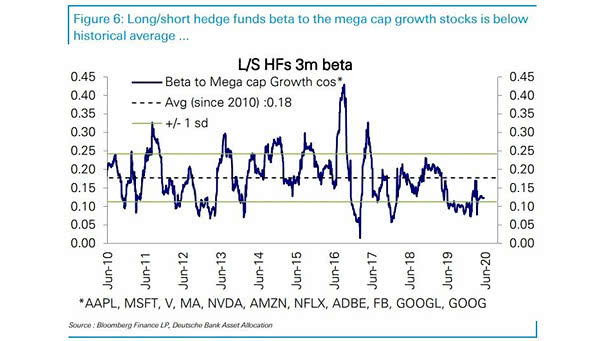

Long/Short Hedge Funds Beta to Mega Cap Growth Stocks

Long/Short Hedge Funds Beta to Mega Cap Growth Stocks Hedge funds aren’t chasing the current market rally, as long/short hedge funds beta to the mega growth stocks is below historical average. Image: Deutsche Bank Asset Allocation