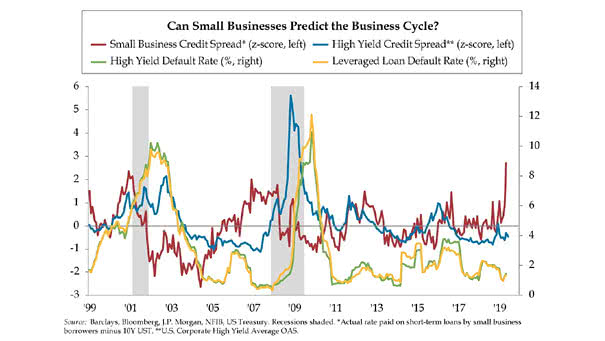

Can Small Business Predict the Business Cycle?

Can Small Business Predict the Business Cycle? A widening high-yield spread remains a useful indicator for predicting a coming recession in the current interest rate environment. You may also like “A Widening of Credit Spreads Is Very Useful to Predict a Recession.“ Image: Quill Intelligence, LLC