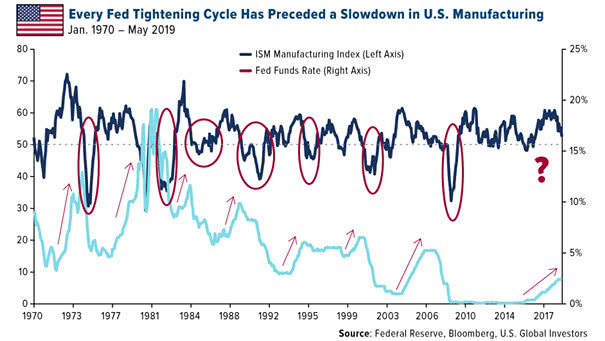

Every Fed Tightening Cycle Has Preceded a Slowdown in the ISM Manufacturing Index

Every Fed Tightening Cycle Has Preceded a Slowdown in the ISM Manufacturing Index Since 1950, pullbacks in the ISM Manufacturing Index has coincided with a recession or market selloff, except in 1995. Image: U.S. Global Investors