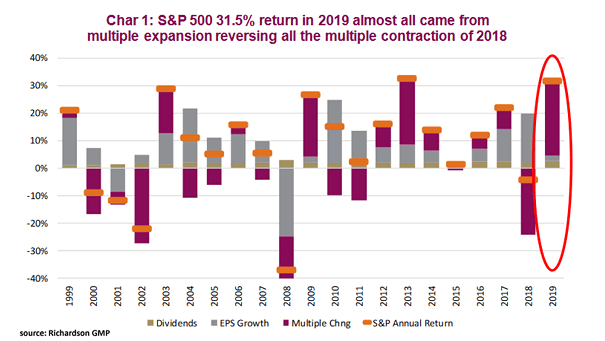

S&P 500 Annual Return: Dividends, Earnings Growth and Multiple Expansion

S&P 500 Annual Return: Dividends, Earnings Growth and Multiple Expansion In 2019, the S&P 500 rose 31.5%. 26.9% came from multiple expansion, 2.6% from dividends, and 2.0% from earnings growth. Historically, S&P multiples contract or remain flat following years of big multiple expansion. Image: Richardson Wealth