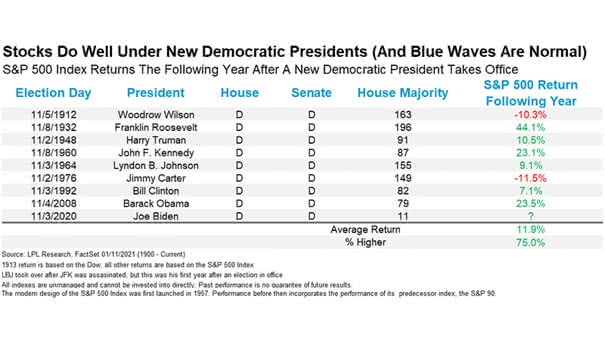

S&P 500 Index Returns the Following Year After a New Democratic President Takes Office

S&P 500 Index Returns the Following Year After a New Democratic President Takes Office It’s officially a blue wave. Historically, the S&P 500 tends to do well under new Democratic presidents. Image: LPL Research