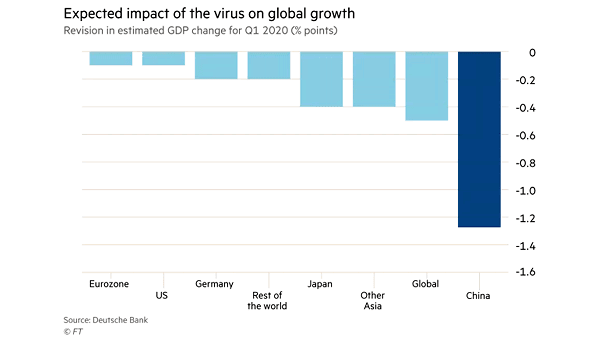

Expected Impact of Coronavirus on Global GDP Growth

Expected Impact of Coronavirus on Global GDP Growth Chart suggesting that in the first quarter of 2020, the Chinese economy will experience its slowest growth since the global financial crisis. Image: Financial Times